Global and European Class 6 Trucks Market Outlook 2025–2035

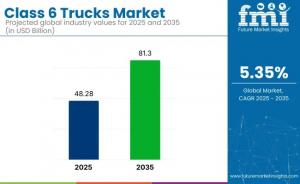

The class 6 trucks market is expected to grow from USD 48.28 billion in 2025 to USD 81.3 billion by 2035, at a CAGR of 5.3%.

NEWARK, DE, UNITED STATES, November 13, 2025 /EINPresswire.com/ -- The global Class 6 trucks market is set for robust expansion, growing from USD 48.28 billion in 2025 to USD 81.3 billion by 2035, at a compound annual growth rate (CAGR) of 5.3%, according to the latest industry analysis. Demand for these medium-duty vehicles is accelerating as logistics, construction, and distribution sectors increasingly depend on efficient, durable, and cost-effective transportation solutions.

Class 6 trucks—typically rated for 19,501 to 26,000 pounds GVWR (Gross Vehicle Weight Rating)—are vital in urban and intercity operations. Their versatility makes them indispensable for fleets managing heavier payloads without the operational complexities of heavy-duty Class 8 models. This balance between payload capacity and operational efficiency has positioned Class 6 trucks as the workhorses of modern industrial logistics.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

https://www.futuremarketinsights.com/reports/sample/rep-gb-22333

Industry Growth Anchored by Multi-Sector Demand

The industry’s growth trajectory is being reinforced by structural trends across multiple sectors. Expansion in construction, urban infrastructure, and e-commerce logistics has created sustained demand for mid-sized trucks capable of maneuvering in urban environments while delivering high payload efficiency.

The construction sector, which alone is forecasted to hold 40% of market share by 2025, relies on Class 6 trucks for transporting materials, machinery, and debris. In parallel, logistics and last-mile distribution applications are benefiting from these vehicles’ payload flexibility and fuel economy—two attributes critical for businesses under pressure to optimize operating costs.

Furthermore, the rise of clean transport mandates and smart city initiatives across regions such as India, China, and the United States is catalyzing fleet upgrades toward modern, compliant, and increasingly electric Class 6 vehicles.

Straight Trucks Lead, Diesel Power Dominates the Fleet Mix

By body type, straight trucks are projected to lead the market in 2025 with a 55% global share. Their utility in diverse sectors—ranging from construction and urban logistics to waste collection—positions them as the preferred choice for operators seeking high uptime and versatility.

Manufacturers such as International Trucks and Freightliner are focusing on innovation in chassis design, enhanced durability, and integrated telematics. These improvements help maximize load efficiency while reducing fuel consumption and maintenance costs.

In terms of fuel type, diesel-powered trucks continue to dominate, accounting for 70% of the Class 6 truck market in 2025. Diesel engines remain the backbone of the medium-duty segment, offering unmatched torque, reliability, and endurance—especially for demanding industrial operations.

Manufacturers such as Cummins and Caterpillar are investing heavily in next-generation diesel technology that meets Euro VII and U.S. EPA 2027 emission standards, ensuring compliance while boosting performance. However, the rise of electric Class 6 trucks, supported by growing investments from Volvo Trucks, Daimler, and Isuzu Motors, is expected to gradually shift market dynamics post-2030 as battery technologies and charging infrastructures mature.

Payload and Application Segments Reflect Balanced Industry Growth

The 10–15 tonnes payload segment is set to capture 40% of total market value in 2025, supported by its broad applicability across construction, logistics, and industrial transportation. This weight class offers the optimal blend of fuel economy and payload efficiency, making it the segment of choice for fleet operators in emerging markets.

Meanwhile, construction applications lead with a 40% share, followed by transportation and distribution. Growth in this segment is closely tied to infrastructure investments in Asia-Pacific and North America. OEMs such as Kenworth, Peterbilt, and Volvo Trucks are enhancing models with advanced braking systems, GPS-enabled fleet management, and adaptive suspension technologies to improve safety and efficiency on rugged terrain and urban routes alike.

Key Market Dynamics: Balancing Growth with Regulation

The Class 6 trucks market’s expansion is underscored by two contrasting forces—rising demand for logistics and infrastructure mobility, and mounting cost and regulatory pressures.

On one hand, the global boom in freight delivery and e-commerce has underscored the strategic importance of medium-duty vehicles in urban logistics chains. On the other, stringent emission regulations and high production costs—driven by material innovations, sensor integration, and advanced propulsion systems—continue to challenge profitability.

As Jonathan Randall, President of Mack Trucks, noted, “We see ’24, ’25, ’26 as strong industries in the commercial Class 8 and Class 6–7 segments. Customers are buying and planning on that three-year cycle, but emissions regulations will determine what happens next.” His statement highlights both the cyclical purchasing behavior in the market and the potential headwinds associated with post-2027 regulatory changes.

Regional Outlook: Asia Pacific and the U.S. Lead Market Momentum

Asia Pacific is expected to record the fastest growth, led by India (CAGR: 5.5%) and China (CAGR: 5.4%), as urbanization, industrialization, and infrastructure expansion fuel truck demand.

In India, the government’s emphasis on smart city development, logistics modernization, and emission compliance is accelerating demand for locally produced Class 6 trucks from Tata Motors, Ashok Leyland, and Bharat Benz.

China, with strong industrial and e-commerce ecosystems, benefits from the mass production capabilities of OEMs such as FAW, Dongfeng, and Beiqi Foton, all investing in hybrid and electric truck innovations to meet sustainability goals.

The United States remains a key hub, growing at a 5.3% CAGR through 2035. Market leaders Ford, Freightliner, and Isuzu are advancing electrification and automation technologies, aligned with federal initiatives supporting zero-emission transport and infrastructure modernization.

The United Kingdom and Japan, though smaller in scale, are accelerating adoption of electric and hybrid trucks amid stricter emission norms and urban sustainability mandates.

Personalize Your Experience: Ask for Customization to Meet Your Requirements!

https://www.futuremarketinsights.com/customization-available/rep-gb-22333

Competitive Landscape and Innovation Focus

The global Class 6 truck market is moderately consolidated, led by Daimler Trucks North America, Volvo Trucks North America, PACCAR Inc., International Inc. (Traton SE), and Isuzu Motors Limited. These players are investing heavily in connected vehicle platforms, battery-electric truck portfolios, and hydrogen fuel cell programs.

Recent collaborations underscore the market’s innovation drive:

April 2025 – Ballard Power Systems partnered with Forsee Power and Linamar Corporation to develop a Class 6 hydrogen fuel cell truck for the U.S. market.

September 2024 – Battle Motors introduced the Striker, a non-CDL Class 6 model designed for urban and vocational applications.

May 2024 – Isuzu Motors and Cummins announced a joint development of a new Class 6 range in North America, combining Isuzu’s design expertise with Cummins’ advanced diesel and hybrid powertrains.

Outlook: Smart, Sustainable, and Scalable Mobility

As the medium-duty transport sector undergoes rapid transformation, Class 6 trucks are emerging as the bridge between traditional heavy-duty vehicles and the future of connected, sustainable logistics. Innovations in electric powertrains, telematics, and automation are expected to redefine fleet efficiency and cost dynamics over the next decade.

Similar Industry Reports

Class 7 Truck Market

https://www.futuremarketinsights.com/reports/class-7-truck-market

Class 8 Truck Market

https://www.futuremarketinsights.com/reports/class-8-truck-market

Class 3 Truck Market

https://www.futuremarketinsights.com/reports/class-3-truck-market

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.